Learn About Leasing at Ciocca Toyota of Williamsport

Learn About Leasing Options in Muncy, PA

The content in this section of our website is designed to answer questions you may have about auto leasing. Leasing is a way to finance a vehicle purchase, and it may or may not be the right way for you to acquire your next vehicle. Our goal isn't to convince you to lease, it's to make sure you understand the options you have to pay for your next vehicle so that you can make the best choice for you.

We find that many customers don't really understand how leasing works, but once they do, they enjoy the benefits that come with it. Please feel free to ask our sales or business development personnel any questions you have.

Lease Education Series

How Does Leasing Work?

Auto leasing is a method of financing a vehicle where you only pay for the part of the vehicle you are planning to use and lease charges (like interest on a loan), normally over a term of around 3 years. It is very similar to conventional financing (which has terms ranging from 2 to as long as 8 years), but you don't pay for the entire vehicle.

During the first few years, a new vehicle depreciates the most and requires the least amount of maintenance and repairs. Leasing protects you from excess depreciation by having a guaranteed future value (GFV, or residual value). Since most leases are for a term of around 3 years, and almost all manufacturer base warranties are at least 3 years, this limits your exposure to out-of-pocket repairs and expensive maintenance.

How Does It Work?

Auto leasing is a method of financing a vehicle where you only pay for the part of the vehicle you are planning to use and lease charges (like interest on a loan), normally over a term of around 3 years. It is very similar to conventional financing (which has terms ranging from 2 to as long as 8 years), but you don't pay for the entire vehicle.

During the first few years a new vehicle depreciates the most and requires the least amount of maintenance and repairs. Leasing protects you from excess depreciation by having a guaranteed future value (GFV, or residual value). Since most leases are for a term of around 3 years, and almost all manufacturers base warranty is at least 3 years, this limits your exposure to out of pocket repairs and expensive maintenance.

$40,000 Selling Price

$20,000 G.F.V. (RESIDUAL)

No obligations at the contract end, you have 3 great options:

- Trade or Sell (keep any profit)

Select something new - What if (avoid a loss)

Market conditions change - Keep it (love the car)

Purchase for the option price

$20,000 DIFFERENCE (DEPRECIATION)

Avoid the following potential pitfalls:

- Long Term Contract

- Higher maintenance & repair costs

- Negotiating trade-in values

- Assuming resale risk

- Being out of warranty

The Ciocca Dealerships Express Lease plan gives you the best parts of conventional financing, the opportunity for ownership and profit, and combines them with the best parts of leasing, shorter terms, and guaranteed future value.

Please ask one of our associates if this plan may work for you.

This is an example for illustration purposes only and does not represent an actual transaction.

Resale Risk vs. Resale Value

When a customer purchases a vehicle with cash or traditional financing, they assume all the resale risk. They are at the mercy of the used car market for the resale value of their specific vehicle at the time they want to sell or trade it in. The following nine things have a direct impact on the value of a used car:

- Mileage

- Condition

- Factory Error

- Economy

- Accident

- Color or Equipment

- Time of Year

- Publicity

- Technology

When a customer takes advantage of the Ciocca Express Lease, the risks associated with items three through nine are transferred to the leasing institution. They are only responsible for the lease vehicle's miles and condition at lease end.

Leasing institutions place a guaranteed future value on the vehicle, and if it is worth more than that value at lease end, the customer can take advantage of that potential profit. If the vehicle is worth less, they can turn it in at the end of their lease and let the leasing institution absorb that financial loss.

The Real Cost of Ownership

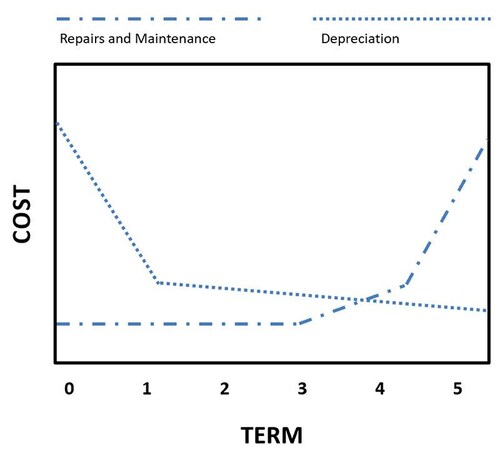

The below graph shows how the cost of depreciation and maintenance & repair change as most vehicles age. Vehicles depreciate the most right after their purchase, while maintenance and repair costs increase significantly as vehicles age. Customers assume the risk of expensive repairs after the warranty expires, and regular scheduled maintenance & normal wear items start to become more expensive as well.

Customers who lease for 3 years or less avoid these more expensive ownership costs by only driving the vehicle when it requires the lowest amount of maintenance and repair, and they control depreciation through the residual value established for their vehicle. People who finance their vehicles on long-term (5 years and longer) finance contracts incur these higher long-term costs on top of their monthly payments. Customers who pay cash or finance their vehicle also have no protection against excess depreciation from factors beyond their control.

Start Leasing with Our Toyota Dealership in Muncy, PA

Are you ready to get started on your leasing journey with our Muncy Toyota dealership? Get in touch with our Toyota finance center and let our expert team help you find the right leasing terms for you. Start your process with ease by applying online and exploring our current new vehicle specials to find a deal for you. Contact us today to learn more about our leasing options and ask our dealership team any questions you have.

Resale Risk vs. Resale Value

When a customer purchases a vehicle with cash or traditional financing, they assume all the resale risk. They are at the mercy of the used car market for the resale value of their specific vehicle at the time they want to sell or trade it in. The following nine things have a direct impact on the value of a used car:

- Mileage

- Condition

- Factory Error

- Economy

- Accident

- Color or Equipment

- Time of Year

- Publicity

- Technology

When a customer takes advantage of the Ciocca Express Lease, the risk associated with items three through nine are transferred to the leasing institution. They are only responsible for the lease vehicle's miles and condition at lease end.

Leasing institutions place a guaranteed future value on the vehicle, and if it is worth more than that value at lease end, the customer can take advantage of that potential profit. If the vehicle is worth less, they can turn the vehicle in at lease end and let the leasing institution absorb that financial loss.

Lease Comparison

Click the links below for examples of a Ciocca lease document.

Ciocca Express Lease Comparison Example - PACiocca Express Lease Comparison Example - NJ

The Real Cost of Ownership

The below graph shows how the cost of depreciation and maintenance & repair change as most vehicles age. Vehicles depreciate the most right after purchase, while maintenance and repair costs increase significantly as vehicles age. Customers assume the risk of expensive repairs after the warranty expires, and regular scheduled maintenance & normal wear items start to become more expensive as well.

Customers that lease for 3 years or less avoid these more expensive ownership costs by only driving the vehicle when it requires the lowest amount of maintenance and repair, and they control depreciation through the residual value established for their vehicle. People that finance their vehicles on long term (5 years and longer) finance contracts incur these higher long-term costs on top of their monthly payment. Customers that pay cash or finance their vehicle also have no protection against excess depreciation from factors beyond their control.

-

Ciocca Toyota of Williamsport

203 Lycoming Mall Drive

Muncy, PA 17756

- Sales: (570) 630-9296